As per the balance sheet, the total assets at the start of the year is Rs.5 lakhs, and the total assets at the end of the financial year are Rs. CalculationĪBC company has a total gross revenue of Rs.20 lakhs at the end of the financial year. The ending assets are the total assets available at the end of the financial year. The beginning assets are the total assets available at the start of the financial year in the balance sheet.

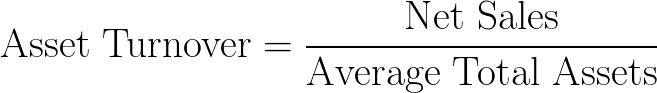

The following is the formula to calculate the average total assets.Īverage Total Assets = (Beginning Assets + Ending Assets)/ 2

Net Sales is the revenue after deducting sales returns, discounts and allowances.Īverage total assets are calculated using the balance sheets from the beginning and end of the financial year. The following is the formula for the asset turnover ratio.Īsset Turnover Ratio = (Net Sales/ Average Total Assets) The company calculates the net asset turnover ratio by dividing net sales by average total assets. Comparing companies within the same sector helps them discover which companies are getting the most out of their assets and what weaknesses others might be experiencing. They evaluate the efficiency of the business operations and learn how efficiently the company uses its resources to produce revenue. Generally, third parties like investors and creditors use this ratio. For instance, a ratio of 0.5 indicates that each rupee of asset generates Rs.0.5 of sales. In other words, this ratio evaluates the company’s gross revenue to the average total number of assets to know how much sales were generated from every rupee of company assets. It measures the company’s ability to generate revenue from its assets. The asset turnover ratio is an efficiency ratio that compares the company’s sales to its asset base.

0 kommentar(er)

0 kommentar(er)